In the 21st century, everyone carries a credit card in their wallet, which can come in handy in various life circumstances. These cards let people in different corners of the world make purchases, book trips and get credit funds right at their fingertips. However, have you ever wondered about how it all began? It’s hard to believe that even in the 20th century, people did not have such an opportunity. The creation of the world’s first credit card has an exciting story that has driven the development of innovation and business worldwide. Learn more at i-new-york.

The birth of the idea of a credit card concept

The history of the creation of the first credit card dates back to 1949 and a person named Frank McNamara. When Frank was having lunch with his clients at a local New York restaurant, Majors Cabin Grill, an unforeseen situation suddenly arose. He had left his wallet at home in another suit. Frank’s wife helped him out of this awkward situation and paid the bill while he himself thought about how convenient it would be to have a payment card for multiple purposes to avoid such occurrences.

Straight after, he discussed this idea with the owner of the New York restaurant and then with his friend and lawyer. Frank realized that this was a revolutionary idea, capable of transforming commerce and making the lives of people across the planet more comfortable.

In 1950, Frank again dined at Majors Cabin Grill, but this time, he paid for his meal with a cardboard payment card. After that, the news spread all over the world. Historians consider this event the beginning of modern credit.

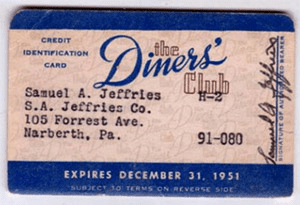

Foundation of Diners Club International company

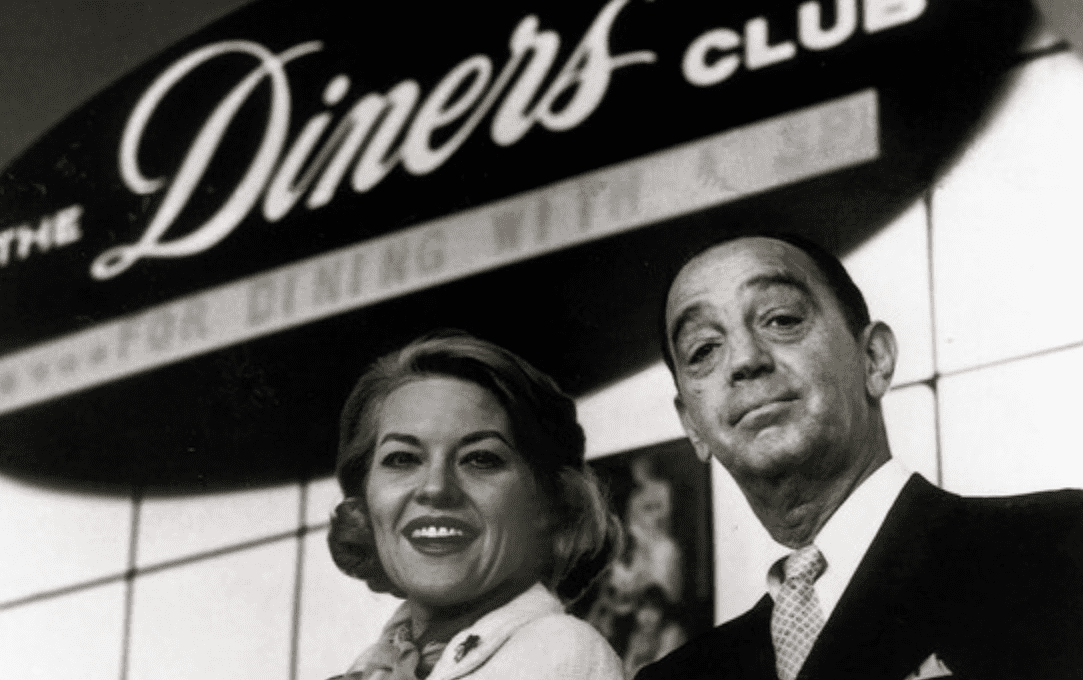

In 1959, Frank and his lawyer founded a company, Diners Club International, that issued charge cards. The initial capital of the company was $1.5 million. The idea was very simple, yet incredibly ground-breaking. With the card, its users could dine at different restaurants in New York and pay the bills later, that is, rest on credit. Soon, Diners Club International began to expand its presence. The credit card could be used not only in local cafes but also in other establishments in New York, such as hotels, car rental locations, flower shops and more. Furthermore, the company began to develop its customer base by offering its innovative cards to well-known New York businessmen.

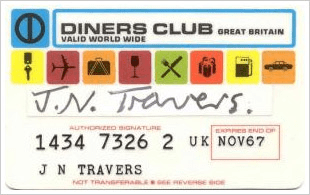

The first Diners Club cards were made of cardboard and were intended for a limited group of clients. This allowed them to pay for food and other necessities. At the end of each month, they would receive a bill for the total amount spent. Frank’s goal was not only to provide a convenient way of payment but also to launch a whole network of establishments that would accept this innovative form of payment.

Development and growth of the number of card users

It should be noted that when the card was first introduced to the public, about 30 partner restaurants and 200 card users were registered with the Diners Club company. These were friends and acquaintances of Frank who wanted to try out his invention. By the end of 1950, more than 20,000 people used cards. The number of users reached 42,000 by the end of 1951. In 1960, the Diners Club had 1.3 million clients. This was a huge breakthrough. Frank proved that his invention was not only convenient but also highly effective.

Entry of new competitors and the first real credit cards

It should be noted that there was no such thing as a “credit card” in the 1950s. Diners Club was considered a regular payment card.

It all started with the Bank of America BankAmericard, which competed with Diners Club International and began issuing revolving credit cards. Other banks and financial institutions began to realize the enormous potential of issuing credit cards. Thus, the first major credit card network was created, known later as Visa.

Another important player in the credit sector was the company Master Charge, better known in the 21st century as MasterCard.

Similar to BankAmericard, Master Charge enabled participating banks to issue cards and start their own regional networks.

Promotion of credit cards

The production of credit cards grew significantly during the 1960s and 1970s. The first credit cards were solely utilized for paying for dinner or lunch at a restaurant, hotel stays or shopping. But within a few years, they became a universal payment instrument. This card allowed one to pay anywhere and at any time.

Credit cards provided high comfort and convenience for their users and increased sales for businesses. All of this contributed to the growth of the economy.

The emergence of modern credit cards

It is worth mentioning that the credit cards we all know in the 21st century came through a long process before they were invented. Previously, there was nothing on a credit card! There was no number, magnetic stripe, CVV code and other.

It took some time for the creators of the credit card to understand the need for its security and modernization. It was only in the 1980s that cards similar to those in the current century appeared. Modern cards have a security CVV code, card number and a magnetic stripe for comfortable shopping.